Summary

In part four of our series, you’ll learn how to find the right transit provider for your peering needs.

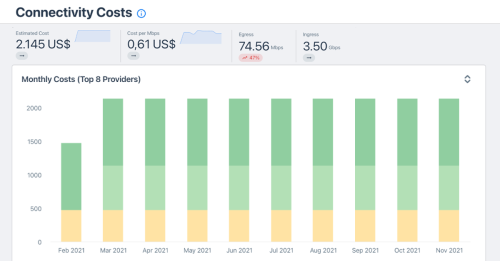

- Part 1 - Economics: How to understand the cost of your connectivity

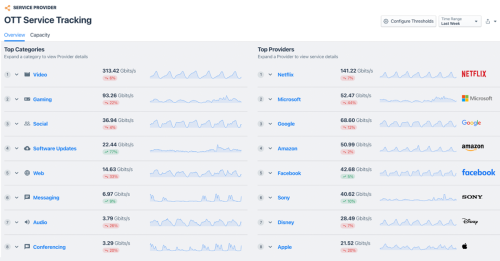

- Part 2 - Performance: How to understand the services used by your customers

- Part 3 - Analyze: How to improve your CDN and peering connectivity

- Part 4 - Select: How to find the right transit provider

The peering coordinator’s toolbox is a blog series where we dive deep into the peering coordinator workflow and show how the right tools can help you be successful in your role.

Part 4: Selection

How to find the right transit provider

In this blog series, we discussed how to peer off or embed IP traffic to optimize your service quality and cost of interconnection. In this final part of the series, we’ll discuss how to select the right transit provider(s).

The requirements for a good transit provider are typically one or more of the following:

- Short path to selected services or networks

- Geographic scope

- Latency

- Packet loss

- Price

- Resilience

Remember, your transit is not only a solution to reach some selected services or networks on the internet, but it’s also the way to reach any destination on the whole internet. It’s also your last resort if there are no other paths in your network to the destination.

Optimal connectivity: Short path to or from selected destinations

If you’ve followed along in previous parts of this blog series, you know that you might have an ASN where peering doesn’t make sense or is not possible. That’s where you know you’ll want to secure the best possible path between you and them.

With Kentik Market Intelligence (KMI), you can look up which providers the target ASN uses and which peers they have. From this list, you can find your potential providers.

The next thing you’ll want to determine is: Where do my potential providers connect to my target ASN?

This is one of the hardest questions to answer. And while many transit providers offer features that can help you answer this question, the two necessary features needed are a BGP community setup and a looking glass.

BGP communities

BGP communities are BGP attribute tags that can be applied to incoming or outgoing routes. This method is often used by transit providers to allow customers to influence the routing policy of their own routes and to communicate information about the routes they send to the customer. The community setup is sometimes publicly available and sometimes only available on request.

A looking glass is a common tool provided by transit providers to their customers. It’s often publicly available as well. The most common features are SNMP pings, traceroutes and queries into the BGP routing table from selected routers in the provider's network.

You will need several types of BGP communities to be available:

- Geographical communities: These are communities that are set by the transit provider on routes they receive from their peers, customers and providers (if they have any). The typical granularity is city, country and continent.

- Propagation control communities: These are communities that you can set on your routes when you announce them to your provider. Based on these, you have some control over how the provider announces your prefixes to their customers, peers and providers.

With this in hand, you can check in the looking glass to see which communities are tagged to the routes from the ASN of your interest.

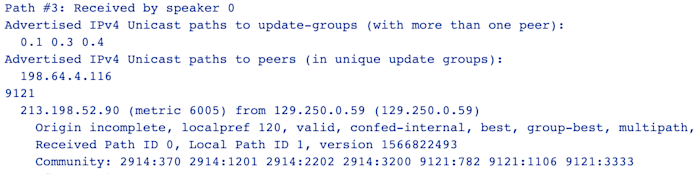

Below is an example of information about a route from AS 9121 in AS 2914’s looking glass from a query done on a AS 2914 router in Dusseldorf, Germany.

The community list is the last line and we can see there are communities set by AS 2914 and by AS 9121. AS 2914 makes their community setup available to the public on their website, so a simple look-up of the list shows:

2914:1201 - route is learned in Dusseldorf

2914:2202 - route is learned in Germany

2914:3200 - route is learned in Europe

It’s then fair to assume that AS2914 and AS 9121 are connected in Dusseldorf, Germany.

This is one way you can check whether the potential provider has a connection to your target ASN in locations that make sense with respect to your desired route for the traffic.

Traceroutes from the potential provider’s looking glass can confirm and give information about the path to the target ASN. So now you know what will happen to your outbound traffic to the target ASN.

Inbound traffic

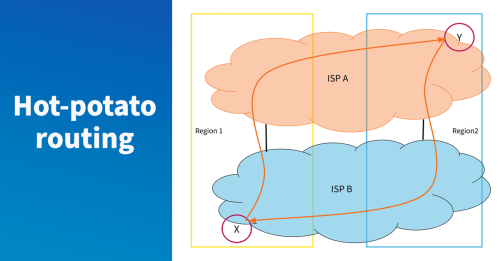

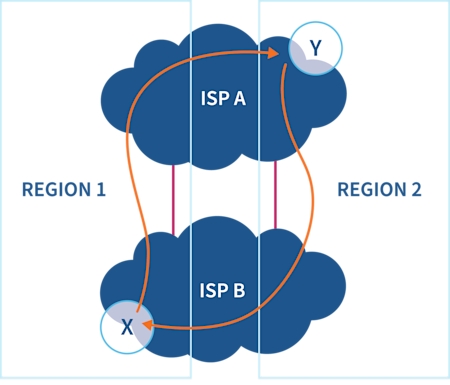

Be aware that transit providers usually use “hot-potato routing.” This means that they will hand off traffic as soon as possible after receiving it.

This means that your inbound traffic might take a completely different route from the target ASN to your network (or to the location of your potential new transit connection).

If the target ASN also provides a looking glass, it is straightforward to check the return path so you can see the path for your inbound traffic from the target ASN to the location of your potential transit connection.

If they do not, the Kentik Global Synthetic Network includes hundreds of strategically positioned global agents in internet cities around the world and in every cloud region within AWS, Google Cloud, Microsoft Azure and IBM Cloud. If there is a global agent in your target ASN, you can use this to see the path from the target ASN for your inbound traffic.

The propagation communities are needed in the case where you want to use a transit provider to reach a few selected ASNs, but not as a full transit provider for the entire internet to reach your network. For example, if your target ASN is a customer of the provider, using a do-not-announce-to-peers community and a do-not-announce-to-upstreams community will restrict your visibility on the internet via this provider.

When you use propagation communities, always make sure that your routes are available to the entire internet via other providers.

Regional connectivity

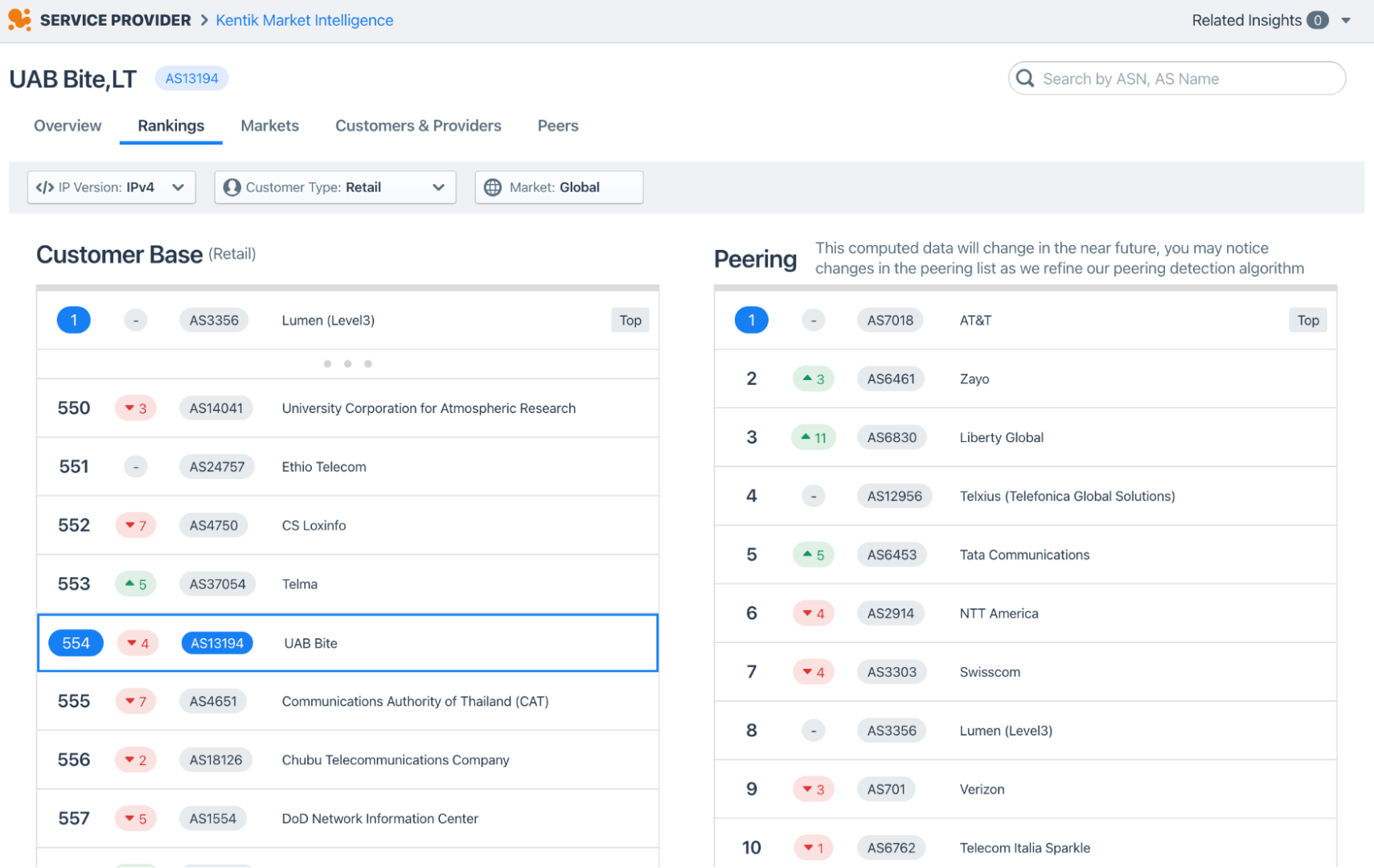

Kentik Market Intelligence (KMI) rankings can help you select the right provider if you need to secure good connectivity to a regional market — be it state, country or selected region.

For example, if you needed to be sure you reached most of Argentina, KMI’s country ranking for Argentina can help you select the best provider for this country.

Global connectivity

When choosing your providers for global connectivity, KMI global ranking is a good guidance of who will be able to provide good connectivity to the entire internet. This will ensure your services are available to everyone. However, sometimes smaller regional providers will make more sense — either because of price or simply availability. The detailed view in KMI will help you understand the connectivity of this provider.

KMI’s “rankings” tab will show how the provider is ranked.

KMI’s “customers and providers” view will show you their connectivity information.

If global reach is essential for your network, maybe a provider who is single homed to another small provider is not the best choice. Someone who has several global networks from the top of the rankings as their providers will likely be a more acceptable option for you.

With that, we conclude our peering blog series. You now have the basics of the economics, analysis, performance and selection processes of peering. Want to know more? Reach out to us for a demo or sign up for a free trial now.